- Investigations are underway after hackers gained access to Equity bank accounts, making away with over KSh 179 Million

- The well-orchestrated online haste happened within a mere seven days, before authorities noticed an unusual surge in transactions originating from the bank’s Incoming MasterCard GL

- By the time the anomaly was identified on Monday morning, over KSh100 million had already vanished, routed through M-Pesa and accounts across 11 different commercial banks

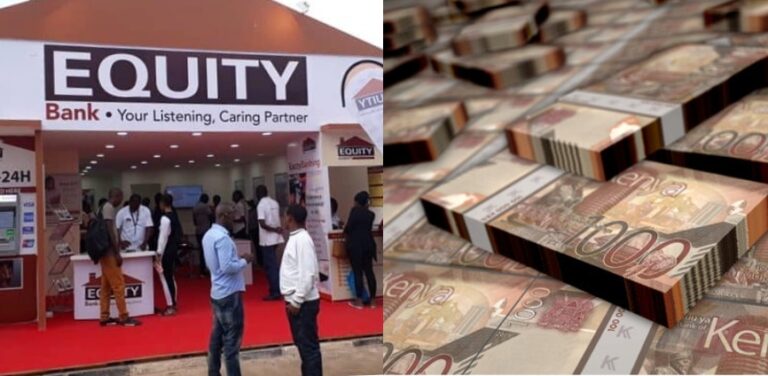

Equity Bank finds itself at the center of a major cybersecurity breach after hackers siphoned off a staggering Sh179 million from 155 accounts within a mere seven-day span.

The brazen attack, detected by the bank’s risk department, prompted immediate action as authorities work tirelessly to contain the fallout and apprehend the perpetrators.

Nairobi News reported that Equity Bank’s risk department noticed an unusual surge in transactions originating from the bank’s Incoming MasterCard GL.

Follow our Facebook page for more updates:

By the time the anomaly was identified on Monday morning, over Sh100 million had already vanished, routed through M-Pesa and accounts across 11 different commercial banks.

Gerald Munyiri, Equity’s General Manager for Security and Investigations, disclosed in the letter, “Preliminary investigations revealed that Sh179.6 million was fraudulently disbursed from the GL to Equity Bank’s 551 accounts during the period.

Must Read:

1: Nigeria’s Access Bank to acquire National Bank of Kenya

2: Wema Sepetu’s Sister, Sunna Sepetu, Nigerian Partner Convicted of Conspiracy to Launder Money in USA

In addition, investigations revealed that Sh63 million was sent to Safaricom M-Pesa and Sh39 million to 11 commercial banks.”

The bank swiftly mobilized efforts in collaboration with law enforcement agencies, Safaricom, and the affected banks to trace and secure the funds while launching a comprehensive investigation to identify the culprits behind the audacious heist.

Follow our Facebook page for more updates:

In response to the crisis, Equity Bank has taken proactive measures by imposing a lien of Sh60.7 million on the 551 compromised accounts and soliciting the assistance of Safaricom to track down the missing Sh100 million.

The incident underscores the pervasive threat of cybercrime in the banking sector, prompting heightened scrutiny and regulatory action.

The recent passage of the Computer Misuse and Cybercrime (Critical Information Infrastructure and Cybercrime Management) Regulations, 2024 by the National Assembly empowers security agencies to bolster cybersecurity measures and combat fraudulent activities in cyberspace.

The regulations, encapsulated in Legal Notice No. 44 of 2024, fortified by the National Computer and Cybercrimes Coordination Committee (NC4), aim to fortify critical information infrastructure across key economic sectors such as telecommunications, banking, transport, and energy.

Central to the regulations is the establishment of a National Cybersecurity Operations Centre, tasked with enhancing coordination and information sharing among stakeholders to mitigate cyber threats effectively.

Follow our Facebook page for more updates:

Additionally, the regulations delineate comprehensive strategies to tackle cybercrimes, including fraud, identity theft, and hacking, while advocating for capacity building initiatives to bolster cybersecurity resilience across public and private entities.